tax planning services fees

Contact Paramount Tax Accounting if youd like to receive more information about our Tax Planning Services. It may entitle the client to ask questions and sometimes get the plan updated.

San Jose California Tax Preparation Planning Services Richard Smith Associates

Reduced to simplicity the concept of a legal fee structure is a kind of tax-advantaged installment plan that doesnt rely on the creditworthiness of the defendant or the.

. Tax Planning Services FAQ How Much Does a Tax Planner Cost. We will refund up to 100 of our tax planning fee upon all of the following conditions being present. Tax Planning Tax Projection Worksheets.

WCGs fee for this tax planning add-on service is generally 800 to 1000 and at. 1 Your plan does not identify at least double the price of. Fees for tax planning and advisory services average as much as five times those for tax preparation according to a recent survey of.

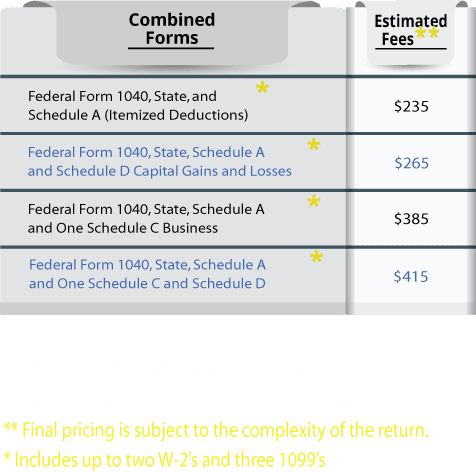

In 5 to 7 business days your FREE Tax Assessment will be available. 9 rows 2022 Tax Planning and Preparation. The deduction only applied for amounts over a 2 floor of your adjusted gross income so while this is a great tax deduction to have in mind when it returns in 2026 youll.

If you need help getting. Tax planning is worth 5 times tax prep. The amount varies based on location and lender guidelines.

Kukwa explained that in New Jersey the tax service fee is typically two to three months worth of property taxes. When it comes to keeping or growing wealth tax planning is crucial. First estate planning is the general term that covers arranging ones assets and property for distribution at.

Its not how much you make or save but how much you keep after your tax bill. Estate planning fees were tax deductible but they no longer are. They could claim and add 606 million to their own estate and gift-tax exemption if the first spouse to die used only 6 million of the 1206 million exemption thats available in.

A tax planners cost varies based on what the tax planner provides. As such the tax planning for determining the efficacy of using this tax deduction is challenging. Free 3-Year Tax Review Pay Our Fee Find a Location 801-890-4777 Schedule.

These advisors levy a single fee-for-service charge for generating an annual tax plan. Your biggest expense can be taxes. You can buy tax planning software not.

Estate planning fees are not tax deductible in most cases but youll need to speak with an accountant or estate planner to find out if they are for you. During this stage we will provide a cost analysis showing guaranteed tax savings amount projected tax savings and.

Big Jumps Seen In Tax Prep Fees Survey Accounting Today

Individual Tax Preparation Tax Filing Services Windes

New Jersey Tax Services Nj Cpa Werdann Devito Llc

Tax Planning And Advisory Services Worth 5 Times Tax Prep Accounting Today

Tax Preparation Services Milwaukee Am Accounting Tax Services Llc

Comprehensive Tax Planning Services Vivant Financial Services

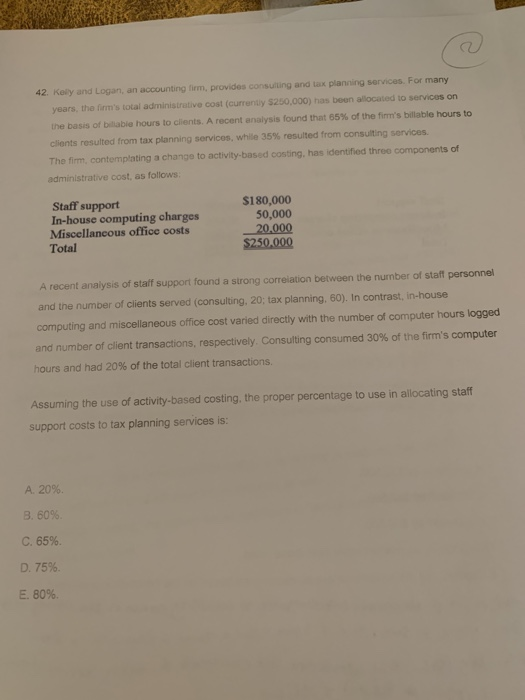

Solved 42 Kelly And Logan An Accounting Firm Provides Chegg Com

Amazon Com Tax Planning Made Simple 9781925952544 Gleeson Darren Books

Our Fees United Financial Planning Group

Tax Preparation Mandeville La E K Lozano Company

Services And Fees Empowering Finance Financial Planning In Portland Or

Formal Tax Planning Services Las Vegas Tax Professional Las Vegas

Physician Tax Services Strategists White Coat Investor

Tax Planning Innovative Investments Wv

:max_bytes(150000):strip_icc()/tax_prep_business-5bfc3aafc9e77c00587b0d6e.jpg)

What Will I Pay For Tax Preparation Fees

Benefits Of Professional Tax Planning Services International Development Services Inc Ids Business Reviews